Image credit: zurijeta / 123RF Stock Photo.

The first quarter of this year wasn’t rosy for Southeast Asian startups.

The number of seed to series C startup deals has hit the lowest mark in three years. Spooked by devaluations in India and the US, investors tell Tech in Asia they’ve tightened their purse strings.

“2016 was a reality check year for everyone,” Jeffrey Paine, managing partner of Golden Gate Ventures, tells me.

According to Tech in Asia’s data, ecommerce investments appear to be down for two straight quarters, though they still form the bulk of deals in Q1. Fintech, while highly touted and now seeing more deals than ecommerce, has not experienced meaningful gains yet.

What is going on?

“It’s not a matter of lack of funds from VCs. There are still a lot of funds available,” says Christopher Quek, managing partner of Tri5 Ventures.

He’s right – it’s not like Japan’s aging population and stagnant economy is going to solve itself, which means Japanese investors will continue to look at Southeast Asia with hungry eyes.

What investors seek now is clarity – in terms of what the next opportunities are. Once that happens, dealflow will pick up again, Chris adds.

What these investment themes are isn’t clear yet. It seems ecommerce and payments are no longer fields that startups can play in, as global and regional tech giants push for consolidation.

See: Southeast Asia’s fintech pivot

So what’s next? Venture funding, like any industry, is cyclical. So a rebound in Southeast Asia seems like a certainty. But what will the rebound look like? Will a single category dominate the dealflow, much like how ecommerce once did?

If so, fintech is the top candidate. Investors, at least, seem bullish about the category.

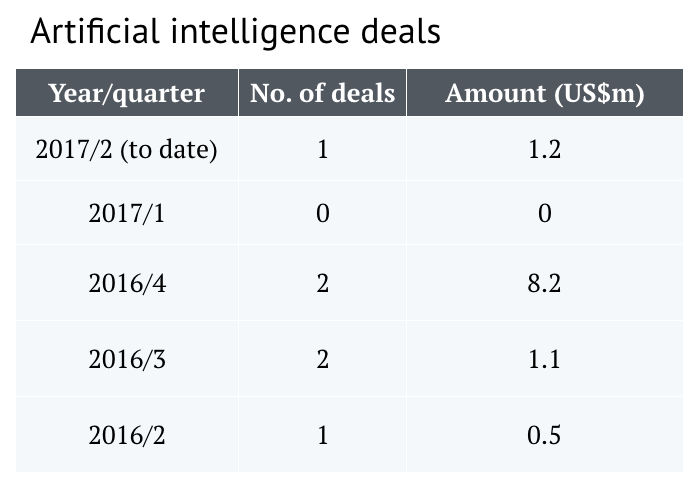

Artificial intelligence has been singled out, though Tech in Asia’s data hasn’t signaled a definite uptrend.

And besides, it’s more likely you’ll see AI embedded across a wide swath of startup types, rather than being a distinct category.

So I peered into our April funding data to find out what the crystal ball shows.

Gaming is a dark horse category.Real estate seems promising. Two such startups, 99.co and MetroResidences, raised series A rounds recently.

This gels with a rise in recent quarters of real estate startups, like Revolution Precrafted and Pegaxis, getting money.

Gaming is a dark horse category. Tech in Asia saw five deals in the past seven months.

We’re not just talking gaming studios. Itemku, a marketplace for virtual goods, raised a series A round. Appota, a company that publishes games and provides tools to help game developers monetize and collect payment, has reached the series C stage. And then there’s Spout, an e-sports startup which raised a US$2.1 million seed round.

Overall, there seems to be a wide variety of recent ideas tackling anything from adtech to video streaming to enterprise software.

Southeast Asia’s new identity may be the lack of a distinct one.

And that is probably a good thing.

This post As Southeast Asia’s tech funding sinks, the search is on for a new identity appeared first on Tech in Asia.