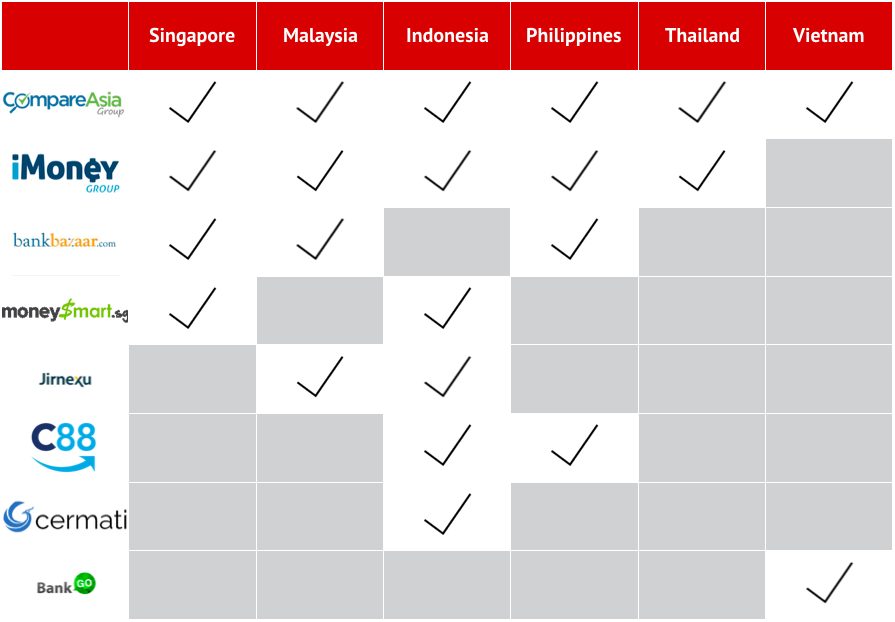

Suppose you want to compare loans, credit cards, or insurance plans. Depending on where you live, your destination would be different: Moneysmart in Singapore, Cermati in Indonesia, or RinggitPlus in Malaysia.

Look at how complicated the financial comparison landscape is in Southeast Asia:

Now, on the surface, RinggitPlus doesn’t stand out – except that it claims to be the number one player in Malaysia, an assertion iMoney would challenge (iMoney did not respond to Tech in Asia’s multiple requests for comment).

But Jirnexu, the company behind the website, is brewing something special. It all started with a revelation.

While the company focused purely on comparing financial products in the first one-and-a-half years of its history, it found that banks lacked an efficient way of converting the leads it provided. This affected Jirnexu’s bottom line, because it collects fees from clients for every approved customer referred.

“I had an overly romantic vision of doing in Southeast Asia what Money Supermarket has done in the UK,” says Siew Yuen Tuck, co-founder and CEO.

No longer just an aggregator

But rather than wait for the market to catch up, Yuen Tuck (YT) took matters into his own hands. His secret weapon: a tool called XPressApply.

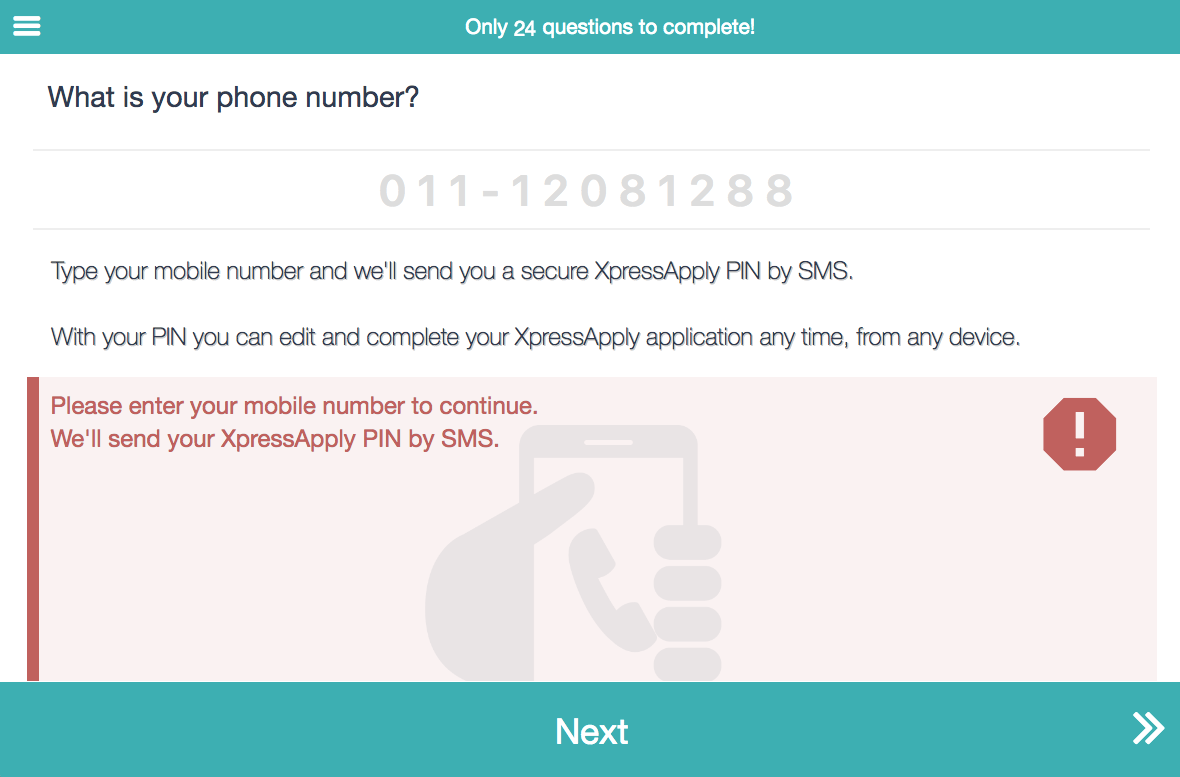

On the consumer side, users can apply for financial products using XPressApply’s easy-to-use, mobile-first interface. The information is then passed on to the financial institution, who can use the tool to acquire and retain the customer. Think of it as CRM software for banks.

Yuen Tuck (seated, with glasses), and the Jirnexu team. Photo credit: Jirnexu.

YT claims that, compared to traditional lead conversion methods, the software has led to a threefold increase in customers acquired.

Banks often hire call centers to manage leads. Agents call up customers, verify their information, and then send them a PDF form which has to be printed, filled out, and then sent back. It’s incredibly tedious.

“Some banks have built online forms where they take their traditional forms and then ask their questions one by one. And sometimes that can be worse in terms of conversion rate because of how they’re designed,” he says.

“A simple banking product is still 30 to 50 questions. If it’s a badly designed form with that many questions, the customer will drop off.”

YT didn’t disclose many numbers. However, he did say that XPressApply has 35 financial institution clients and 1 million monthly visitors across Malaysia and Indonesia.

Based on month-on-month figures and the current sales pipeline, it projects a revenue CAGR of 70 percent from 2014 to the end of this year, and 100 percent growth between this year and last year.

XPressApply’s user-friendly form.

Jirnexu is barrelling full-speed towards becoming a so-called “full-stack” financial services company, which basically means vertical integration.

“We will focus on developing a proprietary risk-scoring capability to provide better matching of consumer risk profiles with lenders and insurers,” says YT.

Good outlook for investors?

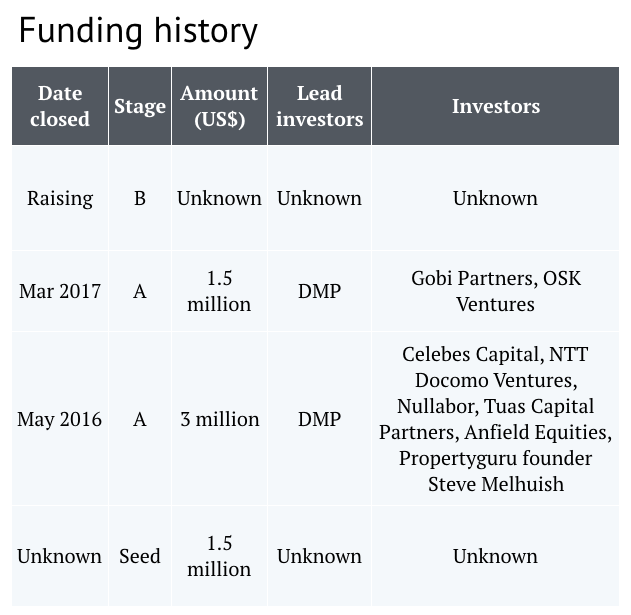

At least some prominent investors are convinced by Jirnexu’s approach: it has just announced raising an additional US$1.5 million to close its series A round.

Reaching profitability is the all-important goal. But if traffic is an indicator, Jirnexu would have to get more than 10 million visitors to achieve this. That’s what India’s Bankbazaar needed to reach positive unit economics.

Reaching profitability is the all-important goal. But if traffic is an indicator, Jirnexu would have to get more than 10 million visitors to achieve this. That’s what India’s Bankbazaar needed to reach positive unit economics.

However, Jirnexu’s new business-to-business approach (it charges clients a “technology” fee for using XpressApply) could make the company harder to replicate and less reliant on site traffic for revenue.

It’s also easy to see why investors, in general, are still enticed by such a competitive space. There isn’t a clear market leader in Southeast Asia. That’s unlike in ecommerce, where Lazada is the only B2B ecommerce marketplace that matters.

Moving forward, we’re likely to see consolidation in this space, perhaps initiated by a foreign company looking to make a splash in the region (Money Supermarket, anyone?). With market leaders already in place and unlikely to budge, the only reasonable expansion path would be through acquisitions.

We could end up with a two-horse race, similar to the PropertyGuru-iProperty dynamic in property classifieds. If a chain of consolidations does happen, it could mean happy outcomes for investors, who can expect small to decent returns.

This article contains the author’s analysis.

This post How Malaysia’s top financial comparison site plans to dominate Southeast Asia appeared first on Tech in Asia.